The Future of Crypto Asset Management in 2025: A Comprehensive Analysis

Introduction

Cryptocurrency has come a long way since the debut of Bitcoin in 2009, evolving from a niche experiment into a global financial phenomenon. By 2025, the crypto asset management industry is expected to be radically transformed by technological breakthroughs, regulatory developments, and shifting investor sentiment. As cryptocurrencies become more integrated into traditional finance, asset managers, retail investors, and even governments are all seeking to define their roles and strategies in this rapidly evolving space.

In this extensive guide—we delve into the most critical aspects of crypto asset management in 2025. We’ll explore how macroeconomic factors influence the crypto markets, examine cutting-edge blockchain innovations, and discuss how institutional players are shaping the industry’s future. We’ll also analyze the meteoric rise of crypto ETFs, dive into hedge fund strategies, and consider the growing impact of DeFi and tokenization. Finally, we’ll look at the regulatory landscape, risk management best practices, case studies, and success stories, culminating in a look ahead at the challenges and opportunities that lie on the horizon. By the end of this guide, you will have a nuanced understanding of the tools, trends, and strategies defining crypto asset management in 2025.

1. The Global Macro Environment for Crypto in 2025

1.1 Continued Economic Uncertainty

The global economic climate in 2025 continues to face significant uncertainties, ranging from volatile energy prices to the lingering impacts of past global crises. Investors worldwide are grappling with fluctuating interest rates, ongoing inflationary pressures, and changes in consumer behavior brought on by technological innovations. Governments have enacted various stimulus measures to stabilize markets, and these moves have led many traditional investors to seek alternatives like cryptocurrencies, which can offer both diversification and potentially higher returns.

Although macroeconomic volatility can introduce additional risk, it also creates windows of opportunity for strategic crypto investments. Historically, Bitcoin and select altcoins have shown uncorrelated or weakly correlated price movements relative to traditional assets, providing a compelling hedge against global uncertainties. In 2025, this dynamic appears to persist, with crypto offering a refuge for those looking to protect against both currency depreciation and stock market downturns.

1.2 Impact on Asset Allocation

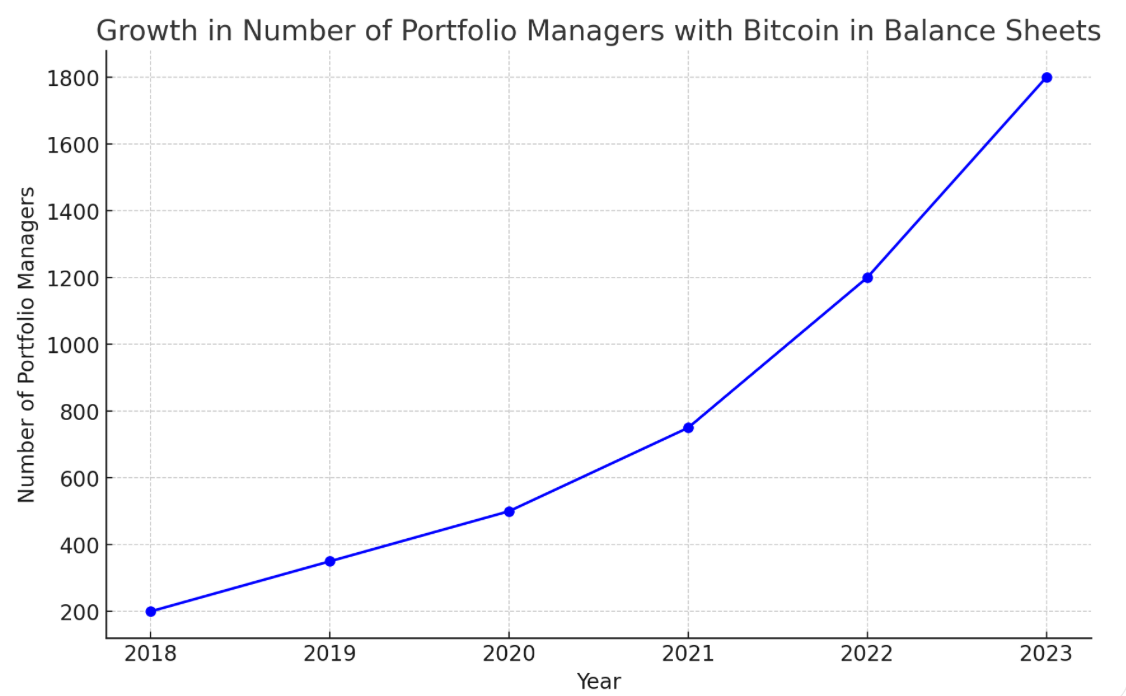

The evolving macro environment drives changes in how investors allocate their portfolios. As central banks grapple with balancing economic growth against inflation, interest rate policies can significantly influence the attractiveness of risk-on assets like equities and cryptocurrencies. A growing number of portfolio managers now regard Bitcoin as a ‘digital gold,’ holding a small but meaningful allocation in crypto to hedge against inflation. This shift in perception has contributed to an ongoing increase in capital inflows, especially from more conservative segments like pension funds.

2. The Evolution of Blockchain Technology

2.1 Layer 2 Solutions and Scalability

One of the biggest hurdles for mainstream crypto adoption has been network scalability and high transaction fees. By 2025, Layer 2 solutions like the Lightning Network (for Bitcoin) and various rollups (for Ethereum) have made significant progress, drastically reducing fees and increasing throughput. Investors and asset managers benefit from these improvements, as higher speeds and lower costs enable more frequent trading, instant settlement, and seamless integration with traditional financial platforms.

2.2 Interoperability and Cross-Chain Bridges

Another area experiencing rapid innovation is cross-chain interoperability. Protocols like Polkadot and Cosmos have matured, offering robust frameworks that enable different blockchains to communicate seamlessly. This interoperability has allowed asset managers to more easily diversify across multiple networks, tapping into the unique strengths of various ecosystems—be it Ethereum’s smart contract dominance or the speed and efficiency of emerging blockchains like Solana.

2.3 Emerging Use Cases

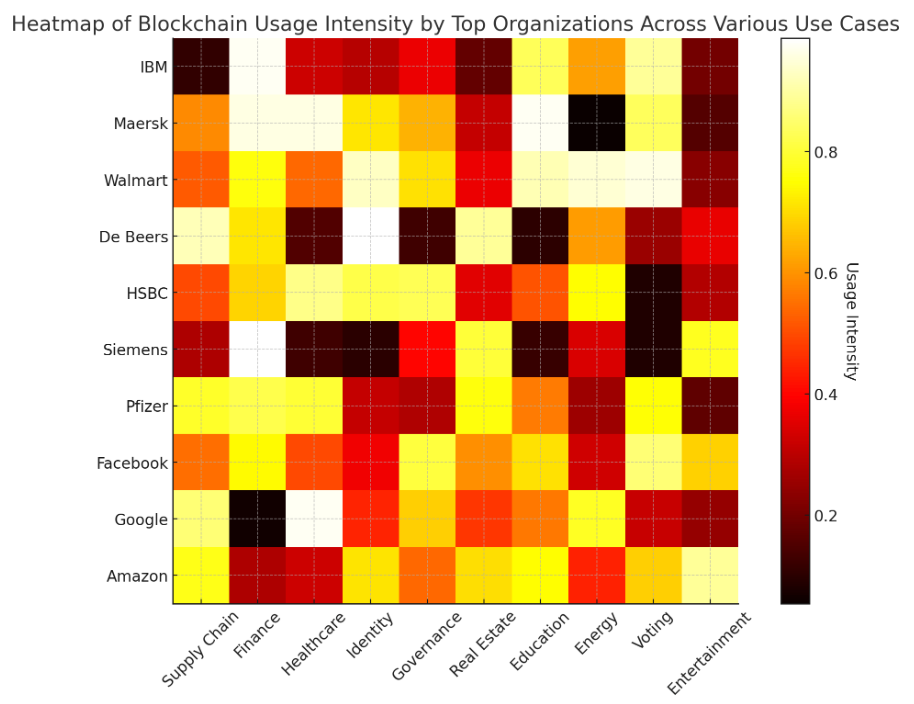

In addition to basic transfers and value storage, blockchain technology is increasingly used for governance, supply chain management, and identity verification. These broader applications expand the asset class beyond tokens like Bitcoin or Ethereum, introducing a wave of specialized digital assets (e.g., supply chain tokens, identity tokens) that asset managers can incorporate into their portfolios. The potential for growth in these niche markets is massive, as real-world tokenization becomes more widespread.

3. Institutional Adoption: How Big Players Are Reshaping the Market

3.1 Pension Funds and Sovereign Wealth Funds

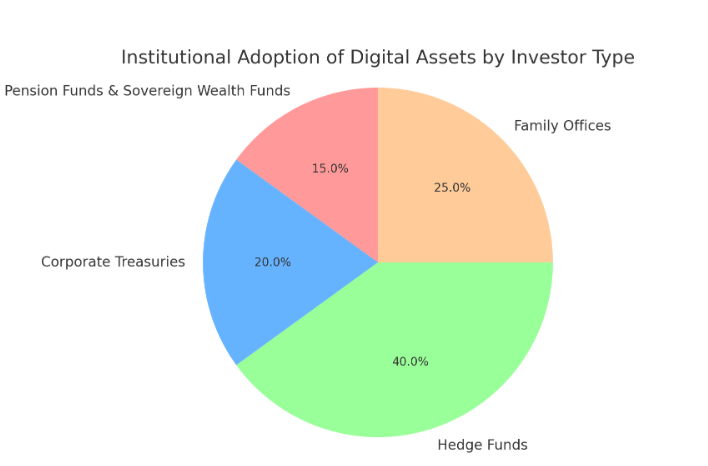

Perhaps the clearest sign of crypto’s maturation is the influx of traditionally conservative institutional investors. Pension funds and sovereign wealth funds—which manage enormous pools of capital—have been cautiously moving into crypto. Between 2023 and 2025, multiple high-profile public pension plans, such as the State of Wisconsin Investment Board, have allocated a small percentage of their holdings to Bitcoin and Ethereum. This trend adds both liquidity and long-term stability to crypto markets.

3.2 Corporate Treasuries

An increasing number of corporations are also allocating a portion of their treasury to Bitcoin and other digital assets as a hedge against fiat currency debasement. By 2025, it’s not just tech companies—manufacturing, retail, and even some government agencies are exploring crypto for treasury diversification. The addition of stablecoins as a medium for corporate payments is another emerging trend, with more reliable liquidity and near-instant settlement compared to traditional bank transfers.

3.3 Hedge Funds and Family Offices

The rise of specialized crypto hedge funds has also piqued the interest of family offices managing the wealth of ultra-high-net-worth individuals. These offices appreciate the market inefficiencies and high volatility in crypto, which present fertile ground for outsized returns through algorithmic trading, market-making, and yield farming in decentralized finance (DeFi) platforms. By the end of 2025, many family offices have a dedicated crypto arm, often partnering with specialized fund managers to navigate the complexities of the space.

3.4 Expert Quote

“Crypto’s potential as a diversified asset class is attracting even the most conservative institutional players.” – Financial Times

4. The Rise of Crypto ETFs

4.1 Understanding the ETF Structure

Exchange-Traded Funds (ETFs) allow investors to gain exposure to a basket of assets through shares traded on stock exchanges. By 2025, crypto ETFs have become a primary gateway for institutional investors seeking a regulated and convenient means to invest in digital assets. Spot Bitcoin ETFs, Ethereum ETFs, and multi-asset crypto ETFs are among the most popular products, each varying in expense ratio and underlying methodology.

4.2 Key Players

Major financial institutions have carved out leading positions in the crypto ETF market:

- BlackRock’s iShares Bitcoin Trust (IBIT): Managing over $50 billion in assets and offering low expense ratios.

- Grayscale: Transitioning its long-standing crypto trusts into ETFs.

- Fidelity: Known for its zero-fee promotions aimed at capturing market share.

4.3 Performance Metrics

| ETF Name | Launch Year | AUM (2025) | Expense Ratio | 2024 Performance | Primary Holdings |

|---|---|---|---|---|---|

| iShares Bitcoin Trust (IBIT) | 2024 | $52 billion | 0.25% | 99% | Bitcoin |

| Grayscale Bitcoin Trust (GBTC) | 2013 (ETF in 2024) | $18.82 billion | 1.5% | 67.59% | Bitcoin |

| Fidelity Wise Origin Bitcoin Fund (FBTC) | 2024 | $9.71 billion | 0.00% (until Aug 2024) | N/A | Bitcoin |

| ProShares Bitcoin Strategy ETF (BITO) | 2021 | $2.04 billion | 0.95% | 51.66% | Bitcoin Futures |

| Bitwise Bitcoin Strategy Optimum Roll ETF (BITC) | 2024 | $4.5 million | 0.85% | 72.71% | Bitcoin Futures |

4.4 Advantages of Crypto ETFs

- Regulatory Oversight: Operate under SEC guidelines.

- Ease of Access: Easily traded through existing brokerage accounts.

- Liquidity: High daily trading volumes.

5. Hedge Funds and Advanced Strategies

5.1 Why Hedge Funds Love Crypto

Crypto’s high volatility and 24/7 trading environment make it appealing for hedge funds seeking alpha. In 2025, top-performing crypto hedge funds often rely on complex strategies spanning arbitrage, algorithmic trading, staking, and yield farming. These funds can outperform more passive vehicles, though the associated risks and fees tend to be higher.

5.2 Notable Crypto Hedge Funds

| Hedge Fund | 2024 Return | AUM (2025) | Notable Achievements |

|---|---|---|---|

| Tephra Digital | 100.2% | $125 million | Advanced DeFi strategies and derivatives trading. |

| Pythagoras Investments | 204% | $233 million | Surpassed Bitcoin’s gains through algorithmic trading. |

| Brevan Howard Digital | 51.3% | $2.4 billion | Launched BH Digital Solutions to manage digital assets. |

| Nickel Digital Asset Management | 35% | $260 million | Benefited from Bitcoin’s rally to $108,000 in December 2024. |

5.3 Market-Neutral and Arbitrage Strategies

One effective approach hedge funds employ in 2025 involves market-neutral strategies, where managers hold offsetting long and short positions to minimize overall market exposure. Funds profit from inefficiencies in the market rather than directional price moves. Meanwhile, arbitrage strategies take advantage of price discrepancies across different exchanges or trading pairs, capturing profits with relatively minimal risk.

6. DeFi and the Tokenization of Real-World Assets

6.1 What Is DeFi?

Decentralized Finance, or DeFi, refers to financial applications built on blockchain networks, particularly Ethereum. These platforms replace traditional intermediaries—like banks and brokerages—with smart contracts. By 2025, the total value locked (TVL) in DeFi has soared as institutional and retail investors flock to yield-farming and liquidity-mining opportunities offering higher returns than many traditional instruments.

6.2 Real-World Asset Tokenization

Beyond DeFi, one of the most revolutionary trends is the tokenization of real-world assets, from real estate to collectibles. Through tokenization, these traditionally illiquid assets can be divided into fractional ownership shares, allowing investors to hold fractions of properties, artwork, or even sports teams. This democratizes access to markets that were previously exclusive to high-net-worth individuals or specialized funds.

Example: A commercial real estate property in New York City could be tokenized on the Ethereum blockchain, with each token representing a share of ownership. Investors worldwide can trade these tokens, providing liquidity and opening the market to a broader participant base.

6.3 Risks and Rewards

While DeFi and tokenization offer enormous potential, they also carry unique risks. Smart contract bugs, regulatory gray areas, and market manipulation remain concerns. Nevertheless, robust audits, insurance protocols, and self-regulatory frameworks are mitigating these issues, attracting serious institutional interest.

7. Navigating the Regulatory Landscape

7.1 Regulatory Milestones

Regulation has advanced considerably between 2020 and 2025. The U.S. SEC has clarified its stance on what constitutes a security token, while the CFTC has outlined rules for crypto derivatives. The European Union’s Markets in Crypto-Assets (MiCA) framework has helped standardize regulations across member states, enhancing investor protection and compliance.

7.2 Global Timeline

| Year | Regulatory Event |

|---|---|

| 2013 | FinCEN mandates AML compliance for crypto exchanges. |

| 2017 | China bans ICOs, ramping up global scrutiny. |

| 2021 | El Salvador adopts Bitcoin as legal tender. |

| 2023 | Full enactment of MiCA in the EU. |

| 2024 | SEC-CFTC agreement clarifies U.S. crypto oversight. |

| 2025 | Proposed global standards by G20 for stablecoins. |

7.3 The Importance of Compliance

Asset managers who ignore regulation face substantial penalties and reputational risks. By 2025, a robust compliance framework, including stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols, is mandatory for any serious player in crypto asset management. Many firms employ specialized legal teams or third-party compliance solutions to navigate the patchwork of global regulations.

7.4 Expert Insight

“Regulation and transparency will be key to driving institutional adoption and stabilizing the crypto market.” – Barron’s

8. Risk Management and Security

8.1 Custodial vs. Non-Custodial Solutions

Managing crypto assets safely remains a primary concern. Institutional investors often opt for qualified custodians—licensed entities that securely store private keys and meet regulatory standards for insurance and audits. Retail investors, on the other hand, may choose hardware wallets or software wallets depending on their risk tolerance. The balance between convenience and security is a personal decision, but in 2025, the industry offers more robust options than ever before.

8.2 Insurance and Fraud Prevention

Cyberattacks and scams have been a consistent threat in the crypto space. As more institutional money flows in, insurance products have evolved, offering coverage for digital assets under specified conditions. Leading insurers are collaborating with blockchain security firms to underwrite policies that protect against theft, smart contract failures, and other operational risks.

8.3 Regulatory Requirements

Regulators worldwide have tightened security standards for exchanges and custodians. Compliance with SOC 2 (System and Organization Controls) and ISO 27001 (Information Security Management) is becoming the norm. Firms lacking these certifications struggle to attract major clients in 2025.

9. Technical Innovations Powering Crypto Asset Management

9.1 AI and Machine Learning

Artificial intelligence is transforming how asset managers assess risk and discover investment opportunities. By 2025, sophisticated machine learning algorithms process extensive on-chain data, social media sentiment, and macroeconomic indicators, generating real-time trading signals. AI-driven portfolio rebalancing automates many tasks once handled by human analysts.

Example: A hedge fund might deploy an AI model that scans global exchange order books, identifying arbitrage opportunities. Once identified, the model executes trades algorithmically, achieving near-instant profits with minimal human intervention.

9.2 Smart Contracts for Automated Fund Management

Smart contracts can automate complex financial processes, from distributing dividends to executing leveraged trades. In 2025, some asset managers rely on fully on-chain solutions, where the entire investment process—contributions, distributions, fee calculations—is governed by auditable smart contracts. This transparency can build trust with investors who can verify every transaction in real time.

9.3 Quantum Computing Concerns

While not yet an immediate threat in 2025, quantum computing looms on the horizon. Quantum computers could theoretically break certain cryptographic algorithms that secure blockchain networks. In response, researchers are developing post-quantum cryptography to future-proof blockchain technology. Some asset managers are beginning to evaluate whether their long-term holdings might require quantum-resistant protocols.

10. Building a Diversified Crypto Portfolio

10.1 Traditional vs. Crypto Diversification

Conventional portfolio theory suggests diversification across asset classes—equities, bonds, real estate, etc. Crypto adds another dimension by offering exposure to an uncorrelated (or differently correlated) asset group. In 2025, many wealth managers recommend including a 1–5% allocation to crypto, depending on risk tolerance.

Here's an updated version of the components of a crypto portfolio, including the additional categories you specified:

10.2 Components of a Crypto Portfolio

- Blue-Chip Cryptocurrencies: This includes Bitcoin, Ethereum, and other high-market-cap assets that are considered stable and foundational to many portfolios.

- Mid-Cap Altcoins: These are projects with strong fundamentals but come with higher volatility than the blue-chip cryptocurrencies. They offer potential for significant growth.

- DeFi Tokens: Governance tokens for decentralized finance platforms involved in lending, exchange, or derivatives trading. These tokens allow holders to participate in protocol governance and potentially earn a share of the transaction fees.

- NFTs and Metaverse Assets: Specialized digital items and assets within virtual worlds that may hold long-term value as the metaverse expands.

- Tokenized Real-World Assets: Fractional ownership in physical assets like property, precious metals, or other commodities, made possible through blockchain technology.

- Algorithmic Trading: Utilizing computer algorithms to trade cryptocurrencies efficiently and at high volumes, often leveraging small price discrepancies for profit.

- Market-Making: Providing liquidity to crypto markets by simultaneously buying and selling cryptocurrencies, helping to stabilize prices and reduce volatility.

- Yield Farming in DeFi Platforms: Engaging in strategies that maximize return on capital by moving assets across various DeFi platforms to take advantage of high interest rates or incentives provided by these platforms.

10.3 Portfolio Rebalancing

Automation is key in 2025, as crypto markets operate non-stop. AI-driven models can execute timely rebalancing based on volatility triggers or market sentiment. Many portfolio managers use specialized trading bots to maintain a target allocation, locking in gains and limiting risk.

10.4 Table: Sample Crypto Portfolio Allocation

| Category | Allocation Percentage (Example) | Risk Level |

|---|---|---|

| Bitcoin and Ethereum | 30% | Moderate |

| Mid-Cap Altcoins | 20% | High |

| DeFi Tokens | 10% | High |

| NFTs/Metaverse Projects | 5% | Very High |

| Tokenized Real-World Assets | 5% | Low/Medium |

| Algorithmic Trading | 10% | High |

| Market Making | 10% | Medium |

| Yield Farming in DeFi Platforms | 10% | High |

11. Case Studies and Success Stories

11.1 Case Study 1: Pension Fund Embraces Crypto

In early 2024, a large public pension fund—facing challenges from low bond yields—allocated 1% of its $50 billion portfolio to Bitcoin and Ethereum ETFs. Over the course of a year, crypto outperformed most of their traditional asset classes, contributing disproportionately to overall returns. While crypto’s volatility was a concern, the pension fund managed it through a gradual buying strategy and by selecting ETFs with robust custody and regulatory compliance frameworks.

11.2 Case Study 2: Small Hedge Fund Finds Opportunity

A boutique hedge fund launched in 2023, focusing solely on algorithmic trading in crypto futures and options. Leveraging AI to identify arbitrage and mean-reversion trades, the fund reported a 150% net return in its first full year of operation. By 2025, it expanded to manage $500 million in assets, attracting interest from family offices and institutional investors looking to diversify into alternative strategies.

11.3 Case Study 3: DeFi Protocol for Real Estate

A real estate investment firm partnered with a blockchain startup to tokenize a portfolio of income-producing properties in Europe. Through this DeFi platform, global investors could buy tokens representing fractional ownership of each property. Rental income was automatically distributed via smart contracts. This approach made real estate investment accessible to smaller investors and boosted liquidity in a traditionally illiquid market.

11.4 Expert Commentary

“These success stories highlight the diverse ways in which crypto assets are being integrated into traditional and alternative finance. From pension funds to specialized hedge funds, the common denominator is robust risk management coupled with innovative technology.” – Coindesk

12. Challenges and Future Outlook

12.1 Volatility and Market Manipulation

Despite greater institutional participation, crypto remains highly volatile. Rapid price movements can be triggered by social media rumors, macroeconomic surprises, or shifts in market sentiment. Manipulation—through wash trading or whale activity—remains a risk, though improved regulatory oversight is gradually reducing these issues.

12.2 Environmental Impact

Bitcoin mining’s energy consumption has been a contentious topic, driving miners to seek renewable energy sources. By 2025, the sector has made notable strides in sustainability, but questions persist about whether proof-of-work can scale responsibly. Emerging consensus mechanisms like proof-of-stake are gaining ground, potentially offering more eco-friendly solutions.

12.3 Technological Complexity

Crypto can be intimidating for newcomers. Wallet management, private key storage, and navigating multiple blockchains require specialized knowledge. Asset managers in 2025 find themselves playing an educational role, guiding clients through the technical aspects of investing in this space.

12.4 Future Innovations

Areas poised for further growth include:

- Metaverse Integration: Virtual worlds with their own economies

- NFT Lending and Borrowing: Collateralizing digital art and collectibles

- DAO Governance Models: Community-driven decision-making for investment funds

- Central Bank Digital Currencies (CBDCs): How they interact with decentralized cryptocurrencies remains an open question

12.5 Table: Potential Future Catalysts

| Catalyst | Potential Market Impact | Timeline |

|---|---|---|

| CBDC Adoption | Could streamline fiat-to-crypto on-ramps | 2025–2028 |

| Quantum Computing | Possible disruption of cryptographic security | 2030+ |

| Mainstream Metaverse | New investment avenues for NFTs and tokens | 2025–2030 |

Conclusion

Crypto asset management in 2025 is more dynamic, complex, and promising than ever. The interplay between macroeconomic forces, technological advancements, and evolving regulatory structures continues to shape this burgeoning industry. Institutional adoption has introduced a level of stability and legitimacy that was almost unimaginable a decade ago, while innovations in DeFi, tokenization, and AI-driven investment strategies create boundless opportunities for growth.

For investors and asset managers, the key to success lies in staying informed and adaptable. Rigorous due diligence, robust compliance frameworks, and forward-thinking investment strategies are essential in a market that never sleeps. As more players enter the space—ranging from pension funds to sovereign wealth funds—the continued evolution of crypto asset management seems all but inevitable.

In the final analysis, the year 2025 stands as a testament to how quickly the financial world can change when innovation, technology, and investor interest converge. Whether you’re a veteran crypto enthusiast or a newcomer exploring this realm for the first time, understanding these trends will be crucial for navigating the opportunities and challenges of this rapidly expanding frontier.

Additional Resources

- CoinMarketCap – Real-time data and analytics on cryptocurrencies.

- Glassnode – On-chain data, charts, and insights for advanced crypto analysis.

- Messari – Research, metrics, and market intelligence for digital assets.

- Investopedia: Cryptocurrency Section – Beginner-friendly guides and definitions.

- Coindesk – News, analysis, and industry updates.